Validate Your Investment Performance

Solutions to enhance investment performance and compliance.

Maximize your investment performance framework with our comprehensive services. Our solutions help you to enhance business models, manage costs, and navigate market challenges effectively.

We are here to help you:

- Achieve Global Investment Performance Standards (GIPS®) compliance.

- Outsource your performance calculations—wholly or partly.

- Refine your performance analytics and reporting.

Whether you are a private equity, private credit, real estate, asset and wealth managers, retail funds, digital assets, hedge fund, asset owners, OCIOs or fiduciary management provider, we’ve got you covered.

Ready to learn more?

Get more information

Expansive client network

active client relationships.

Experienced team

professionals with an average tenure of nine years among project leads.

Credible expertise

consultants holding professional designations, including CFA, CIPM, and CAIA.

We have the largest market share of verified firms in P&I’s top 100 list.

What do you need help with?

Independent performance certifications

Review data and methods for accuracy.

Managed performance services

Outsource performance measurement tasks.

GIPS compliance services

Verify and enhance performance standards.

Focused performance reviews

Optimize reporting and fee structures.

Fundraising IRR readiness assessment

Ensure IRR and performance metrics are consistent with GIPS standards and aligned with FINRA RN 20-21 for private placements.

SEC Marketing rule compliance solutions

Ensure adherence to investment performance obligations.

Ongoing performance consulting

Tailored guidance and training.

Do you need any of these services? Contact us today!

Optimize your investment performance practices with ACA.

Leverage our industry insights, proven methodologies, and deep experience with investment performance best practices.

Enhance the quality, consistency, and credibility of your investment performance reporting.

Client perspectives

We’re certain we can be your ideal partner. But our clients say it best.

ACA Mirabella provides exceptional compliance and regulatory host services, demonstrating impressive competence and responsiveness. Their team consistently offers insightful, timely guidance that ensures regulatory requirements are met efficiently and effectively. We benefit from their deep industry knowledge and proactive approach, making the compliance process smoother and more manageable. ACA Mirabella’s dedication to high-quality service truly sets them apart as a valuable partner in navigating complex regulatory landscapes.

Bruno Pajusco, Founder – CEO, Keridion Capital Management

Compliance and regulatory hosting is a very critical function for us and we wanted to ensure the provider had a long track record, deep bench and good connectivity with banks and other service providers. We evaluated a number of regulatory host providers. ACA Mirabella was our choice as they were ahead of the competition in all the above. In addition, we appreciated their professionalism and advice through the process. Partnering with ACA Mirabella them will allows us to fully focus on investing, knowing we have the right monitoring and controls in place.

Manav Gupta, Founder and CIO, ASVA Investment Partners LLC

Mirabella have been an excellent partner assisting us with our strategic marketing solutions since 2020. The team are both knowledgeable and responsive. There is a depth of understanding of the complex regulatory rules that befits the organisation. They also have a pragmatic approach delivering workable solutions to the complex issues. We are a small marketing team and having Mirabella as an extension of our business has been invaluable.

Jordan Kitson (Chief Financial Officer) – Bury Street Capital Limited

Why ACA?

Discover the ACA difference in investment performanceexcellence, where skilled specialists, innovative technology, and tailored solutions enhance efficiency, reduce risk, and deliver superior results.

Here’s what sets us apart:

Specialized personnel and peer benchmarking

Access the largest team of experts with deep investment performance knowledge and unparalleled peer industry insights.

Maximized resource utilization

Benefit from customized solutions that enhance efficiency and make the most of your existing resources.

Industry-leading thought leadership

Tap into our expertise to stay informed and continuously improve your investment performance practices.

GIPS® is a registered trademark owned by CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.

FAQs

Investment Performance

What is Investment Performance Advisory Solutions, and why are they important for financial services firms?

Investment Performance Advisory Solutions encompass services that assist financial firms in accurately calculating, analyzing, and reporting investment performance and analytics. These solutions are crucial for ensuring transparency, maintaining client trust, and complying with industry standards and regulations.

What regulations govern investment performance reporting?

Key regulations include the SEC’s marketing rule and FINRA advertising rules. The Global Investment Performance Standards (GIPS®) is the industry standard for the calculation and presentation of performance. Other jurisdictions-specific regulations ensure fair and ethical performance reporting.

What are the Global Investment Performance Standards (GIPS®), and why should firms comply?

The GIPS standards are an industry-recognized standard for the calculation and presentation of investment performance that promote transparency and comparability. This voluntary compliance demonstrates a firm’s commitment to best practices, enhancing credibility with investors.

What is the process for achieving GIPS compliance?

The process includes defining firm-wide policies, ensuring accurate portfolio data, calculating investment performance, and creating compliant performance presentations. Firms can also choose to undergo independent verification to provide assurance on whether the firm’s policies and procedures, calculation, presentation, and distribution of performance, have been designed in compliance with the GIPS standards and have been implemented on a firm-wide basis.

What is the benefit of having independent GIPS verification?

Independent verification enhances credibility, provides assurance on whether the firm’s policies and procedures, calculation, presentation, and distribution of performance, have been designed in compliance with the GIPS standards and have been implemented on a firm-wide basis, and provides assurance to investors that the firm follows best practices in performance reporting.

How can firms ensure accurate investment performance calculations?

Firms should follow standardized methodologies, maintain accurate and complete data, and use technology to automate calculations while adhering to industry standards.

What are common mistakes in investment performance reporting?

Errors often include misrepresenting past performance, inconsistent calculation methodologies, incomplete disclosures, failure to update performance data regularly, and the inappropriate inclusion or exclusion of portfolios from composites.

How do compliance teams help with performance marketing and investor communications?

Compliance ensures that marketing materials and investor reports accurately reflect performance data, meet regulatory requirements, and avoid misleading claims.

How does compliance with investment performance regulations reduce risk?

It mitigates legal and reputational risks by preventing misleading reporting, ensuring adherence to fiduciary responsibilities, and reducing the likelihood of regulatory fines or enforcement actions.

What role does the SEC play in investment performance compliance?

The SEC enforces advertising and marketing rules for investment performance, requiring firms to provide fair, balanced, and non-misleading performance disclosures.

What investment performance services does ACA provide?

We offer a comprehensive suite of investment and managed performance services, including GIPS® standards compliance support, outsourced head of performance, private fund fundraising and reporting support, as well as key performance task outsourcing.

Why should firms choose ACA for investment performance compliance?

We are uniquely positioned at the intersection of investment performance and regulatory compliance—bringing both under one roof. Our team combines deep expertise in investment performance and data analytics with a thorough understanding of regulatory requirements, ensuring comprehensive and compliant solutions. With a dedicated staff of over 80 professionals—the largest team of its kind in the industry—we offer an unmatched depth of knowledge and specialization. We proudly serve more than 1,100 clients, providing not only expert guidance but also peer insights that few others can match.

How does ACA help firms achieve and maintain GIPS compliance?

We provide end-to-end support for GIPS compliance, including policy development, performance calculations, verification services, and best practice guidance to meet industry standards.

What is involved in ACA’s GIPS verification process?

We conduct an independent review of a firm’s policies and procedures, performance data, and disclosures to confirm compliance with GIPS standards enhancing credibility and investor confidence.

Can ACA assist firms in transitioning to GIPS compliance for the first time?

Yes, we work with firms at all stages of compliance, from initial implementation to ongoing adherence, ensuring a smooth transition and continued compliance.

How does ACA support firms in performance measurement?

We provide consulting on performance calculation methodologies, benchmarking, and risk analytics to ensure firms meet regulatory and industry best practices.

Does ACA help firms improve investment performance reporting?

Yes, we assist with reviewing and enhancing performance reports, disclosures, presentations, and peer insight to ensure compliance with regulatory requirements and industry standards, as well as maintaining a competitive edge in this landscape.

How does ACA assist with performance marketing materials?

We review marketing materials and investor communications to ensure performance data is presented fairly, accurately, and in compliance with SEC, FINRA, and GIPS standards guidelines.

Can ACA help firms meet SEC and FINRA performance advertising regulations?

Yes, we provide guidance on compliance with SEC and FINRA advertising rules, ensuring firms present performance data transparently and avoid misleading claims.

What role does ACA play in regulatory examinations related to investment performance?

We assist firms in preparing for regulatory exams by conducting mock audits, reviewing policies, and ensuring documentation aligns with regulatory expectations.

Does ACA offer technology solutions for investment performance compliance?

We provide technology-driven solutions that streamline performance reporting, automate calculations, and ensure accuracy in investment performance compliance.

Can ACA integrate investment performance compliance services with a firm’s existing technology?

Yes, we work with firms to integrate compliance processes with their existing performance measurement and reporting systems.

What is GIPS compliance, and how does ACA assist firms in achieving it?

GIPS compliance involves adhering to standardized guidelines for calculating and presenting investment performance, ensuring consistency and comparability across firms. We assist by guiding firms through the compliance process, conducting verifications, and providing ongoing support to maintain adherence to GIPS standards.

How does ACA address the compliance talent shortage in the investment performance sector?

We have introduced Managed Performance Services, combining proprietary technology with a team of over 80 investment performance professionals. This offering helps firms globally to outsource performance measurement and reporting functions, addressing the operations talent shortage effectively.

How does ACA ensure that our firm's performance reporting aligns with industry best practices?

We stay abreast of industry developments and regulatory changes, integrating this knowledge into our advisory services. We work closely with your firm to ensure that performance reporting meets current best practices and regulatory standards, enhancing credibility and client trust. Additionally, we are a part of industry organizations that create standards like GIPS, ILPA, and AIMA.

Contact us

Learn from our experts

In today’s complex and competitive investment landscape, investment firms must navigate various challenges that can …

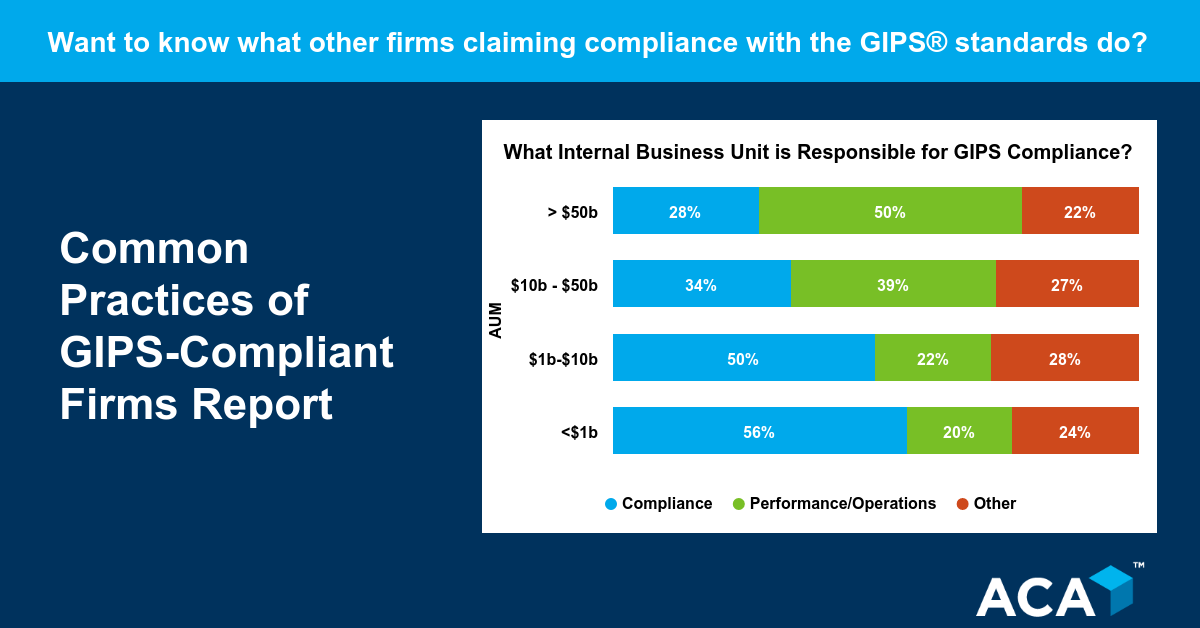

A firm that claims compliance with the Global Investment Performance Standards (GIPS®) has many decisions …

The Securities and Exchange Commissions’ (SEC) Rule 206(4)-1 (Marketing Rule) under the Investment Advisers Act …

Skip to content

Skip to content