Home Technology Vantage for Cyber

Vantage for Cyber

Purpose-built cybersecurity oversight for private markets.

ACA Vantage for Cyber (“Vantage”) is the only cybersecurity solution designed specifically for private equity, venture capital, real estate, and private debt firms to assess and monitor portfolio cybersecurity risks. With ACA Vantage for Cyber, you gain continuous visibility into cyber risks across your portfolio, empowering smarter investments and risk management, stronger valuations, and operational efficiencies.

Get more information

Lorem Ipsum

portfolio companies monitored and overseen by ACA Vantage

Lorem Ipsum

private equity companies supported by ACA Vantage

Your Strategic Edge in Private Market Investing

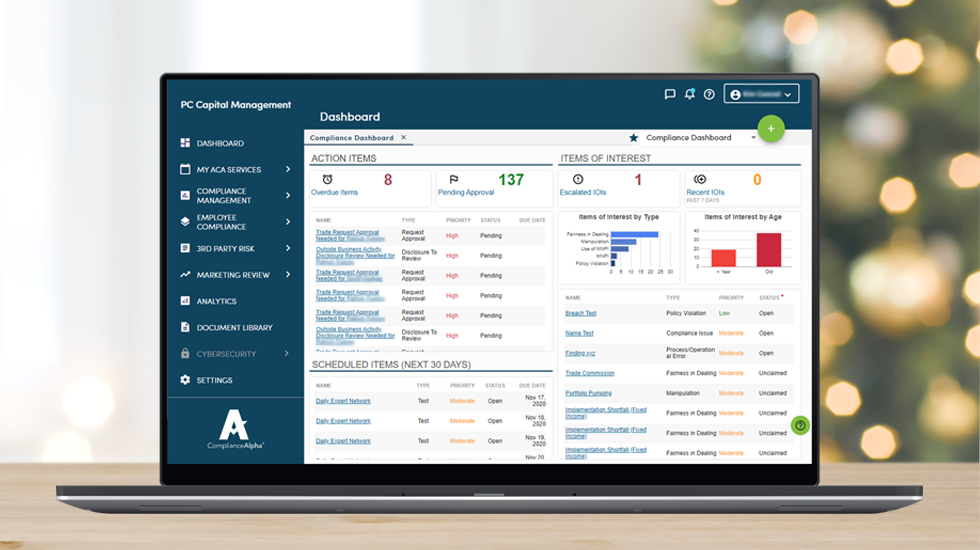

Powered by ComplianceAlpha®, ACA Vantage gives operating partners the contextualized risk data they need to conduct cross-portfolio comparisons, quickly identify and prioritize critical areas for improvement, and track portfolio company (“PortCo”) remediation. With flexible and customizable dashboard reporting, Vantage enables sponsors to analyze data from every angle; turning complex, and often disjointed risk data, into clear, actionable insights.

Our proprietary RealRisk assessment methodology delivers contextualized risk scores and recommendations by factoring in PortCos’ business characteristics (e.g., industry, revenue, operational complexity) and sponsors’ investment context—alongside their cybersecurity posture.

Displayed in the Vantage dashboard, RealRisk scores give operating partners a single view to compare risks across their portfolio and identify high risk PortCos.

Our Risk Program Manager (RPM) feature turns Vantage assessments into a dynamic workflow, enabling sponsors and PortCos to collaboratively track cybersecurity risk remediation in a centralized register.

Risks, whether identified through Vantage, third parties, or internal reviews, are logged with severity, source, remediation plans, owner, and deadlines giving sponsors real-time visibility into remediation across the portfolio, while PortCos benefit from a centralized tool.

Our cybersecurity advisors work with sponsors to build scalable oversight programs rooted in governance, risk management, and value creation.

Throughout the year, our advisors work with sponsors to derive insights from Vantage data on progress and risk trends, prepare reports, present to key stakeholders, make recommendations on vendors and opportunities to leverage economies of scale, and work directly with PortCos as needed.

Secure and Sustain Your Investments

Connect with us to learn how Vantage for Cyber can help your firm establish a scalable oversight program, engage stakeholders with clarity, and drive measurable impact across your portfolio.

Client Perspectives

We’re certain we can be your ideal partner. But our clients say it best.

With ACA Vantage, we now have increased visibility into where companies stand in terms of their vulnerabilities and their risk levels.

Jeff Steinhorn, Operating Partner, Gridiron Capital LLC

A year into the program, Vantage has provided a lot of value to our portfolio companies. We plan to get ACA involved in much earlier stages of our next investments to improve our partnership.

– Steve Cherington Head of Operations, Ara Partners

Turn Cyber Oversight into a Strategic Advantage

Cyber oversight isn’t just about protection; it’s about performance. From reducing risk exposure to improving fund performance and investor confidence, our solution is built to deliver measurable value across your portfolio.

Improve ROI Through Risk Management

ACA Vantage for Cyber enables you to reduce value erosion from unseen risks by continuously monitoring your PortCos’ cyber posture in a cost-effective way.

With real-time visibility and expert guidance, you can identify threats that matter most to your fund’s performance and respond quickly and efficiently to emerging risks.

Create Value Through Oversight

Our solution helps you build a track record of cyber program improvements that enhance exit valuations. ACA works with your investor relations team to align oversight with limited partner expectations and acquisition value drivers, making your program a strategic asset during diligence.

We also streamline vendor selection and program design, saving time and effort while ensuring consistency across your portfolio.

Manage Operational Expenses

ACA Vantage allows you to right-size your oversight program to meet regulatory expectations without overspending.

You’ll uncover opportunities to leverage economies of scale, reduce cyber insurance costs for PortCos, and eliminate the overhead of building and maintaining cyber standards from scratch.

Connect with us to learn how Vantage for Cyber can help your firm establish a scalable oversight program, engage stakeholders with clarity, and drive measurable impact across your portfolio.

Why ACA?

Unlock value and performance with ACA Vantage. Our comprehensive solutions are designed to elevate your portfolio oversight and monitoring and drive exceptional results.

Here’s what sets us apart:

Comprehensive Monitoring and Oversight

Gain a 360-degree view of your portfolio with tools and insights for effective management of performance and risk.

Enhanced Performance

Boost ROI with targeted oversight. Streamline operations and improve overall performance for greater success.

Tailored Expertise

Benefit from our industry-specific knowledge and customized solutions for multiple asset classes.

Contact Us

FAQs

Vantage for Cyber

What is ACA Vantage for Cyber and how does it support private equity cybersecurity oversight?

ACA Vantage for Cyber is a purpose-built solution that enables private equity, venture capital, real estate, and private debt firms to monitor and manage cybersecurity risks across their portfolio companies. It provides continuous visibility, investment-weighted risk assessments, and expert program development to support compliance, valuation growth, and operational efficiency.

How does ACA Vantage improve ROI from cybersecurity risk management?

ACA Vantage helps firms reduce value erosion by continuously monitoring cyber posture across their portfolio. It identifies high-impact risks, enables faster response to threats, and ensures resources are allocated to the areas that most affect fund performance.

Can ACA Vantage help portfolio companies qualify for cyber insurance?

Yes. ACA Vantage provides benchmarking and analytics that help assess cyber insurance eligibility. By strategically targeting cybersecurity spend to address high impact areas, firms can reduce the cost and complexity of obtaining cyber coverage for their portfolio companies.

What makes ACA Vantage different from other cybersecurity solutions?

ACA Vantage is designed specifically for private market investors. It combines real-time monitoring, context-aware risk assessments, and expert advisory services to deliver strategic value, not just technical protection.

What are the advantages of ACA’s Managed Services for investment companies?

ACA’s Managed Services allow firms to outsource critical compliance functions such as surveillance, testing, and reporting. This reduces internal workload while ensuring regulatory accuracy and timeliness.

Learn from our experts

FAQs

Regulatory reviews and mock exams

Why should my firm conduct a mock exam or regulatory review?

A mock exam helps identify compliance gaps, test internal controls, and ensure your firm is prepared for regulatory scrutiny. It allows you to address deficiencies proactively rather than reacting to potential enforcement actions.

How often should we conduct a regulatory mock exam or audits?

Firms should conduct mock exams, review, or health check at least annually or whenever there is a significant regulatory change, internal restructuring, or an upcoming regulatory inspection. High-risk firms may benefit from more frequent reviews.

How can I prepare my team for a regulatory review?

Beyond conducting mock exams, firms should:

- Regularly train employees on compliance best practices

- Ensure documentation is accurate and up to date

- Use technology solutions to enhance surveillance and reporting

- Conduct ongoing self-assessments to detect and mitigate risks early

What areas are assessed in a regulatory review or mock exam?

We assess key compliance areas, including:

- Policies and procedures – Ensuring documentation aligns with regulatory expectations

- Governance and oversight – Evaluating internal controls and reporting structures

- Surveillance and monitoring – Reviewing trading activity and compliance technology usage

- Recordkeeping and reporting – Identifying deficiencies in regulatory filings

- Staff readiness – Testing employee knowledge and preparedness for regulatory inquiries

What happens after a mock exam or review?

You can receive a detailed report outlining strengths, weaknesses, and recommended actions to enhance compliance readiness. We can also support remediation efforts, including updating policies, training staff, and improving governance structures.

Does ACA provide regulator-specific mock exams and audits?

Yes, we tailor each mock exam to align with the specific focus areas and methodologies of different regulators. For example:

- SEC exams – Data-driven testing, surveillance reviews, and trade analytics assessments

- FCA reviews – Conduct risk evaluations, thematic reviews, and ICARA assessments

- NFA exams – Risk-based compliance checks and supervisory framework testing

- FSRA & DFSA inspections – Governance and risk management assessments

Which regulators do you cover?

We provide mock exams and compliance reviews tailored to regulatory expectations for:

- U.S. Securities and Exchange Commission (SEC)

- U.K. Financial Conduct Authority (FCA)

- U.S. National Futures Association (NFA)

- Abu Dhabi Financial Services Regulatory Authority (FSRA)

- Dubai Financial Services Authority (DFSA)

How does ACA conduct mock exams?

Our process includes:

- Preliminary risk assessment – Understanding your firm’s operations and regulatory exposure

- Document and policy review – Analyzing compliance frameworks, reporting procedures, and internal controls

- Interviews and testing – Engaging key personnel to assess regulatory preparedness

- Findings and recommendations – Providing a detailed report with action items to strengthen compliance

- Ongoing support – Assisting with remediation, staff training, and continuous monitoring

Skip to content

Skip to content